Courtesy image

Courtesy image

Writer Ashley Chea and her family

Holiday sales are set up to make us think we are saving money, but are we really making the best decisions for our family’s financial health and longevity? Ashley Chea is here to help us answer that question with five tips on how to avoid over-spending this holiday season.

Here come the holidays, and here comes money being spent and love being shown through purchases and payment plans. Don’t get me wrong – I love a good sale and the feeling of gifting the ones I love with new items. The problem is that we seemingly put ourselves in worse financial positions right before the year ends when really we should be setting ourselves up for the next year and maybe knocking out some debt.

Holiday sales are set up to make us think we are saving money.

Also, at no time is spending money saving money. We get so hyped up and tell ourselves we got a discount, but in reality, if we didn’t spend the money in the first place we would still have it. I’m not saying you shouldn’t buy anything. I am saying let’s take a moment to spend wisely and to find a way to enjoy the holidays without feeling depressed over money spent or not having the money to spend in the first place.

Related Articles:

How We Got Out of $100,000 of Debt (and You Can, Too)

We’ve Got Options: Healthy Holiday Dishes With FitMenCook

Are Finances a Problem in Your Marriage?

Here are four tips I use during the holiday, and really all year round, to make sure I am spending wisely and, more importantly, not living in excess.

Tips to Avoid Overspending This Holiday Season

Courtesy image

1. Make a gift list – It makes it easier to stay focused on only purchasing items you intended to buy and not grabbing extra items just because they are marked down.

2. Give before you get – Take a stroll around your house and go through each room and get rid of items you haven’t used/clothes you haven’t worn. Donate items in good condition and toss useless items. This will also help you to clear space and realize things you may or may not really need.

3. Budget – This should really be #1 on the list. Make a realistic budget for buying gifts and spending on holiday sales. If possible, use cash instead of your card. I’ve noticed that there is something about using cash that makes me a little more reserved when spending it.

4. Shop online – Most stores have the same pricing online, so there’s no need to wake up early and spend all day in long lines or fighting over half-priced toys and items that your kids won’t even want a month from now. Spend more time with your family and buy most of your items online.

The reality is that we want to create financial wellness and wealth within our communities.

Overspending and wasting money is a habit we should leave in the past. So start thinking more long-term and necessity-based when spending your money. We aren’t in competition with one another, and our worth is not defined by how many “things” we can buy. Minimalism isn’t a lifestyle for everyone, but there is a space between overspending and minimalism. Responsible and resourceful spending should be on everyone’s list.

Related Articles

Bozoma Saint John talks Black motherhood, grief, self-love, and finding joy again. Don’t miss her powerful conversation on building legacy and living boldly.

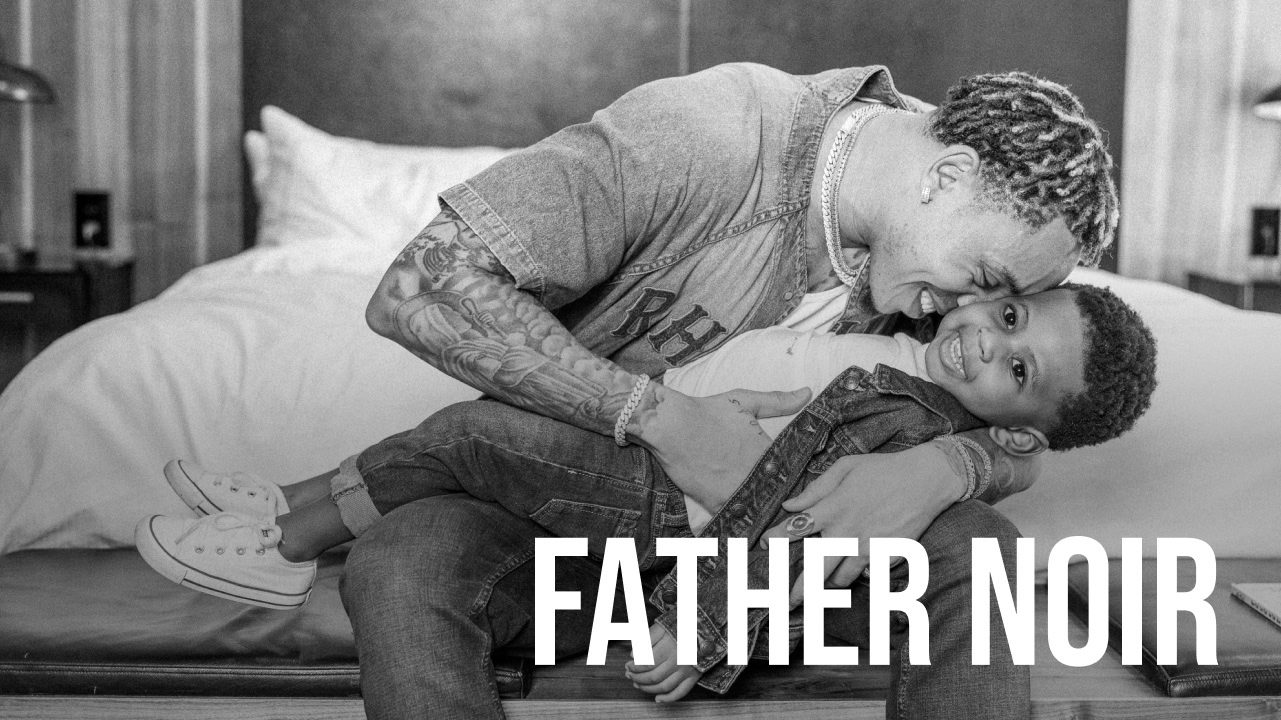

Tyler Lepley shows the beauty of Black fatherhood, blended family life with Miracle Watts, & raising his three children in this Father Noir spotlight.

Black fathers Terrell and Jarius Joseph redefines modern fatherhood through love, resilience, unapologetic visibility in this Father Noir highlight.

Featured Articles

When Elitia and Cullen Mattox found each other, they decided that they wanted their new relationship together, their union, to be healthier and different.

Celebrate their marriage and partnership with the release of the documentary “Time II: Unfinished Business”

The vision for our engagement shoot was to celebrate ourselves as a Young Power Couple with an upcoming wedding, celebrating our five year anniversary - glammed up and taking over New York.

Meagan Good and DeVon Franklin’s new relationships are a testament to healing, growth, and the belief that love can find you again when you least expect it.

Our intent is to share love so that people can see, like love really conquers everything. Topics like marriage and finance, Black relationships and parenting.

HEY CHI-TOWN, who’s hungry?! In honor of #BlackBusinessMonth, we teamed up with @eatokratheapp, a Black-owned app designed to connect you with some of the best #BlackOwnedRestaurants in YOUR city – and this week, we’re highlighting some of Chicago’s best!