Woman on laptop

Courtesy of Pexels.com

Finance expert Tonya Rapley (Photo courtesy of Jerome Shaw)

Finding love is fantastic, and having your finances in order as you navigate that path is a nice bonus — literally! So Tonya Rapley, the millennial owner of the financial education and lifestyle blog My Fab Finance organized five days of online programming to help you (and your boo) get your money right, and blacklove.com is front and center with insights!

As a writer who focuses on personal finance, wellness, and relationship topics, I understand why this is important. If your accounts are together, you can be financially free to focus on other areas of your life, including finding and maintaining love. But the truth is the stress is real! With the current economic crisis, including roughly 3.3 million initial claims for unemployment filed in the United States just during the week ending March 21, 2020 (a record high) is enough to make your anxiety peak to new levels.

If you’re in a money crunch, you have to be nimble about changing your financial plan. A big must is to figure out which bills to pay first to stay afloat.

Courtesy of Pexels.com

If you are experiencing money anxiety, we’ve included a few tips below on how to level up during these uncertain times.

Prioritize your bills.

If you’re in a money crunch, you have to be nimble about changing your financial plan. A big must is to figure out which bills to pay first to stay afloat. With social distancing in effect at both state and federal levels — along with business closures — you should be conscious of your spending habits. Tonya Rapley suggests paying bills in the following order: rent or mortgage, food, and medication, followed by transportation, especially if you need it for work.

Then focus on your essential bills and utilities, debt; savings; and any other expenses. “You want to have a roof over your head,” she notes, adding that this order can vary, depending on your situation. For instance, you may want to put bills and utilities in third place, which makes sense to me, and if you can’t swing saving while you’re trying to survive, that is fine.

Communicate with your lenders.

Many lenders are working with customers in need and offering options such as reduced payments, payment deferrals, waived fees, or forbearance. This means your payments are on hold—but still due at a determined time. The key is to learn what you need to do and make the necessary adjustments to pay what you can when you can. All funds will be due; eventually, Rapley notes. Keep in mind; you don’t want a mountain of bills when this is all over.

Related: Money Expert Tonya Rapley on How to Survive and Thrive in an Economic Crisis

Check on your student loans.

According to Rapley, required payments for federal student loans are effectively on hold until September 30, 2020, which means these accounts won’t accrue interest until then. “Basically [they] will be frozen,” she says. So, if needed, contact your federal loan provider to request forbearance due to COVID-19 related issues, Rapley further suggests. If you have private loans, contact those lenders to ask if they can help, too.

Be smart with your stimulus check.

With the passing of the $2 trillion stimulus deal, many adults will receive $1,200, depending on income and eligibility. In general, if you have a social security number and an adjusted gross annual income (per 2018 or 2019 taxes) of less than $75,000, you should receive the full amount, with this sum decreasing until it stops altogether for single people making more than $99,000. But there are some restrictions. If you are eligible for these funds, Rapley advises being mindful and saving if possible. You can also file for unemployment if you’re jobless due to the pandemic, she also says. Another piece of advice is to check in with your state, municipality, or professional organizations and associations for more help.

Now is the time for side hustles and digital options abound. If you’re struggling, it’s important to consider eliminating unnecessary expenses .

Courtesy of Pexels.com

Be responsible about debt.

Prioritize your debt and manage any discrepancies that could result in legal action, Rapley says. Then take time to consider any additional funds owed and, by all means, try to avoid making emotional decisions. Ideally, you’ll want to continue paying at least the minimum due on all debt to avoid making your situation worse.

Make your money stretch.

Now is the time for side hustles and digital options abound. If you’re struggling, it’s important to consider eliminating unnecessary expenses such as gym memberships. Since the majority, if not all of these facilities are closed, take advantage of rerouting that money to essentials.

Prepare for the next emergency.

If you have a money management problem now, be aware of that. Use this time to make a note of how much money you need each month to ensure your basic household needs are met. Since it can take a few months to find a job if you’re unemployed, Rapley suggests growing a future emergency fund. So if you find yourself struggling again, this will help you secure a bit of a safety net.

Created by nationally recognized millennial money expert Tonya Rapley, My Fab Finance is a leading financial education and lifestyle blog for millennials who want to become financially free and do more of what they love.

Disclaimer: blacklove.com does not offer any financial advice, and the views and opinions expressed in this article are the author’s viewpoints and opinions.

Related Articles

Bozoma Saint John talks Black motherhood, grief, self-love, and finding joy again. Don’t miss her powerful conversation on building legacy and living boldly.

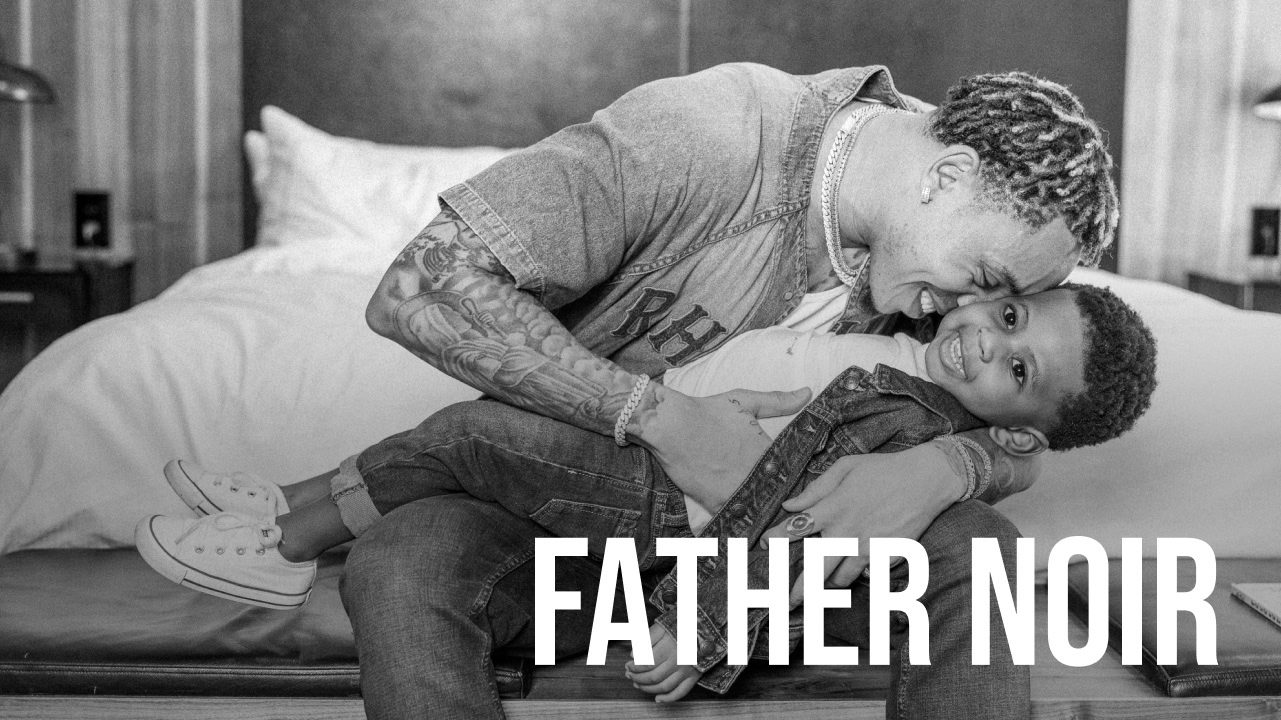

Tyler Lepley shows the beauty of Black fatherhood, blended family life with Miracle Watts, & raising his three children in this Father Noir spotlight.

Black fathers Terrell and Jarius Joseph redefines modern fatherhood through love, resilience, unapologetic visibility in this Father Noir highlight.

Featured Articles

When Elitia and Cullen Mattox found each other, they decided that they wanted their new relationship together, their union, to be healthier and different.

Celebrate their marriage and partnership with the release of the documentary “Time II: Unfinished Business”

The vision for our engagement shoot was to celebrate ourselves as a Young Power Couple with an upcoming wedding, celebrating our five year anniversary - glammed up and taking over New York.

Our intent is to share love so that people can see, like love really conquers everything. Topics like marriage and finance, Black relationships and parenting.

Meagan Good and DeVon Franklin’s new relationships are a testament to healing, growth, and the belief that love can find you again when you least expect it.

HEY CHI-TOWN, who’s hungry?! In honor of #BlackBusinessMonth, we teamed up with @eatokratheapp, a Black-owned app designed to connect you with some of the best #BlackOwnedRestaurants in YOUR city – and this week, we’re highlighting some of Chicago’s best!