@thefinancebar/Instagram

@thefinancebar/Instagram

Made in Partnership with Chase

Courtesy of Pexels.com

I don’t know about y’all, but I have “Walking” by Mary Mary on repeat because of the way these gas prices are looking that’s exactly what I’m going to be doing, haha! The way cost of living has been slowly increasing, and like plenty of others, I’ve been looking for ways to better manage my finances. The racial wealth gap was already impacting Black households before the pandemic, but after the pandemic shook the economy, it also shook up the homes and stability of minorities even more. According to NPR.org, “Black and Latino households, more than 55% reported serious financial problems.”

“About 19% of households say they lost all their savings during COVID-19 outbreak.”

Yet as the pandemic slowly fades away, inflation is on the rise which means people everywhere are looking for ways to get back on their feet by increasing their income and budgeting their spending. As I too am working on bettering my finances and discovering information to become financially resilient, I could never be more grateful for the show “All Things Money” on the BlackLove+ App. Practical and realistic shows like this give me hope that these numbers have some truth but don’t have to be our forever reality. Say this with me “One day I will be a lender, not a borrower.”

Related Articles:

How We Got Out of $100,000 of Debt (and You Can, Too)

How to Discuss Finances With Your Partner and When

Finding Financial Guidance (VIDEO)

I come from a family that’s more familiar with government assistance and payday loans than they are mortgages, investing and 401(k)’s so trust me when I say I know what it feels like to live in financial uncertainty, especially when you’re in a generational cycle of robbing Peter to pay Paul.

CNBC shared that only 7.4% of Black and Brown students are required to take a stand-alone [financial education] course, which continues to feed the disparities of the racial wealth gap. Financial literacy about budgeting, saving, and investing isn’t a frequent conversation happening in our Black homes or school systems.

Looking back at my upbringing I remember most conversations around money only being about the 1st or 3rd, which is why it probably took me a while as an adult to get to a place where I could actually track my spending habits, schedule auto payments, and not be afraid of checking my mail or seeing the 1st.

I always say you can’t budget your way out of poverty, and I’ll say it again, for the people in the back who don’t understand the disparities of the financial gap. You can’t budget your way out of poverty. Although, you can inform yourself of resources, pray and use techniques to get yourself out. So it’s imperative that we have these conversations and have access to content creators and shows like “All Things Money” so we can “equalize understanding” when it comes to financial principles for a better quality of life.

If you can relate to yearning for more financial wellness knowledge, here’s a diverse list of 10 creators and experts in the financial world you should be following. Finance is such a broad term, but these experts below cover multiple areas of the finance world, are Black, and teach from a place of experience and knowledge. Am I the only one who loves learning from experts who incorporate their personal experiences? Tap into them below!

Men in Finance

@betterwallet (Debt and Budgeting)

Credit: @betterwallet

Marc of @betterwallet is known on Instagram for helping people strategically manage their money. His cultural references and tough love posts are what get through to his audience, cause you know us Black folk can be stubborn when it comes to talking about our money, now!

@popcornfinancepodcast (Short-Form Financial Advice and How-To’s)

View this post on Instagram

@popcornfinance is a short-form podcast that discusses money within the same amount of time it takes to pop popcorn (now, that’s clever!) Sometimes conversations around money can be long and overbearing but his content is short, simple, and free.

@theisaiahjackson (Bitcoin and Black America)

View this post on Instagram

Isaiah, of @theisaiahjackson, uses his platform to inform his audience on Bitcoin, Crypto, and Black America. He’s discussed “The Promises of Bitcoin” on a panel with AfroTech while he travels often to inform and empower the Black men in our communities on these topics.

Women in Finance

@thebrokeblackgirl (Financial Activist, Competency-Based Education, Black Feminist)

View this post on Instagram

Dasha, my personal fav! She is a financial activist and educator that provides us with realistic, tangible resources. Through sharing her own personal story, she’s helped thousands of women including myself negotiate fees with banks and loan companies, and how to put together simple saving plans. Not only is her content relevant and consumable, but it’s also relatable. She lowkey feels like a financial auntie at this point, haha.

@millenialindebt (Personal Finance and Debt)

View this post on Instagram

The Beyonce of Personal Finance, @Millennialdebt is known for teaching millennials how to build generational wealth. Not only does she have educational content, but content that will make you laugh too! Anything that makes learning financial freedom fun, I’m sold into!

@thefinancebar (Personal Finance and Wellness)

View this post on Instagram

As seen on ESSENCE and CNBC, The Finance Bar is serving its audience through understanding financial wellness. Specifically through helping their audience simplify their debt, saving techniques, and budgeting.

@myfabfinance (Personal Finance and Education)

View this post on Instagram

Our girl Tonya!!! She’s curated a safe space for women to learn about money specifically through affirmations, recognizing money wins, retirement, and roundups of resources. Tonya’s platform is vibrant, informative and will leave you feeling on top of the world

@delyannethemoneycoach (Investing/Stock Market)

View this post on Instagram

Delyanne is an Investing Coach who teaches investors how to slay and navigate the stock market. With a podcast with CNN and free tangible guides, Delyanne is leading the conversation around investing, building generational wealth, and understanding.

@frugalfeminista (Budgeting/Saving)

View this post on Instagram

Kara, of @frugalfeminista, is helping her audience of over 11K how to heal their relationship with money. I love this because there are tons of techniques and guides out there to help us physically get our finances together but we can’t forget about the mental work it takes to actually live in financial wellness. Her content provides resources and advice on what you need to change your mindset and relationship with money.

@theashleyfrance (NFTs)

View this post on Instagram

Ashley is an NFT marketing consultant who shares information, and specific platforms/resources for people to buy or sell NFTs. She breaks down her content to help people understand the NFT world in simple, accurate, and quick terms.

After going through these pages, I hope you feel as empowered as I do to take control of your finances. I know this all can seem overwhelming at first, but knowledge and access is the best tool to help us get ahead. I’d also like to encourage you to go at your own pace and don’t be dismayed by what you see other people buying and doing online. This financial journey became so much easier for me when I stopped comparing myself to people who didn’t come from where I come from and started extending grace to myself.

@thebudgetnista (Financial Educator)

View this post on Instagram

Tiffany Aliche, founder of “The Budgetnista”, is an award-winning teacher of financial education, and America’s favorite personal financial educator. She is the author of Get Good with Money (a New York Times Bestseller), The One Week Budget, and the Live Richer Challenge series. Through her company, ‘The Budgetnista’, Tiffany has created a financial movement that has helped over one million women worldwide completely transform the way they think about their finances.

@sage.money (Financial Coach)

View this post on Instagram

A nationally recognized financial coach, educator, consultant, and dynamic motivational speaker, Saundra is passionate about her work with community-based organizations and bridging the gap between financial services and low-wealth communities.

After going through these pages, I hope you feel as empowered as I do to take control of your finances. I know this all can seem overwhelming at first, but knowledge and access is the best tool to help us get ahead. I’d also like to encourage you to go at your own pace and don’t be dismayed by what you see other people buying and doing online. This financial journey became so much easier for me when I stopped comparing myself to people who didn’t come from where I come from and started extending grace to myself.

For more financial well tips, be sure to tune in to new episodes of #AllThingsMoney presented by Chase for Wealth Wednesdays on Instagram

Related Articles

Discover why Jasmine Guillory’s latest novel Flirting Lessons is a must-read—and how the author continues to redefine modern romance with layered Black heroines, real emotional depth, and Black literature that feel both magical and true.

Bozoma Saint John talks Black motherhood, grief, self-love, and finding joy again. Don’t miss her powerful conversation on building legacy and living boldly.

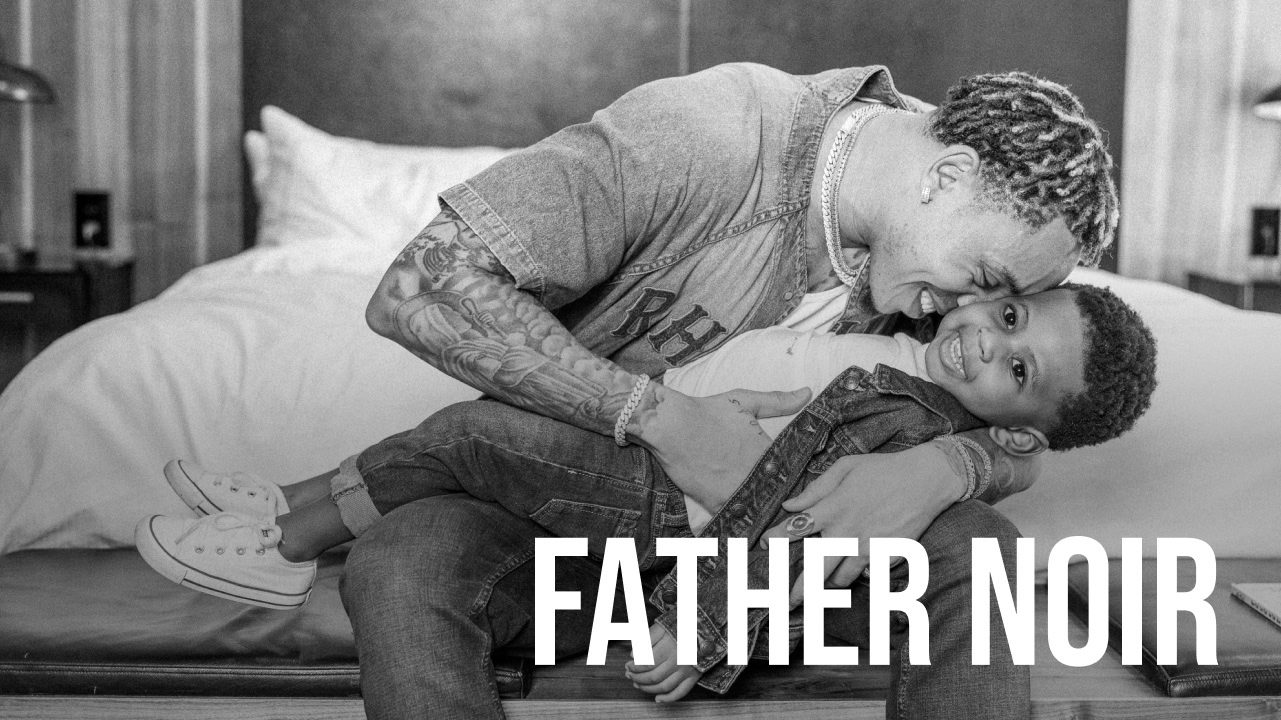

Tyler Lepley shows the beauty of Black fatherhood, blended family life with Miracle Watts, & raising his three children in this Father Noir spotlight.

Featured Articles

When Elitia and Cullen Mattox found each other, they decided that they wanted their new relationship together, their union, to be healthier and different.

Celebrate their marriage and partnership with the release of the documentary “Time II: Unfinished Business”

Our intent is to share love so that people can see, like love really conquers everything. Topics like marriage and finance, Black relationships and parenting.

The vision for our engagement shoot was to celebrate ourselves as a Young Power Couple with an upcoming wedding, celebrating our five year anniversary - glammed up and taking over New York.

Meagan Good and DeVon Franklin’s new relationships are a testament to healing, growth, and the belief that love can find you again when you least expect it.

HEY CHI-TOWN, who’s hungry?! In honor of #BlackBusinessMonth, we teamed up with @eatokratheapp, a Black-owned app designed to connect you with some of the best #BlackOwnedRestaurants in YOUR city – and this week, we’re highlighting some of Chicago’s best!