Untitled – 2020-04-01T123021.959

Kevin L. Matthews II (Photo courtesy of Kevin L. Matthews II)

Recently, I’ve referred to today’s stock market as a rollercoaster when writing about personal finance. That’s because we’ve seen lows — like the major plunge in March 2020 — and a few highs. Because of this, since the market doesn’t operate in a straight line, it’s important to keep your emotions in check, whether you’re buying individual stocks, investing via your 401(k) retirement account, or more. You should also be mindful of several other key components when investing in a downturn.

Day two of My Fab Finance‘s five-day webinar series focused on investment tips for chaotic times, investing basics, and tools for building wealth. The featured speakers were Tonya Rapley and Kevin L. Matthews II. Rapley, an entrepreneur and creator behind the series that seeks to help millennials “break the cycle of living paycheck to paycheck.”

And Kevin is an author and former financial advisor who launched BuildingBread in 2010 “to inspire millennials to set, simplify, and achieve any financial goal.”

As a cautionary tale, the market has historically righted itself over time, but it’s not a place for emotions.

Courtesy of Pexels.com

Investments in index funds, which are funds that have a preselected collection of stocks and bonds or sometimes both, offer ways to gain exposure in the market at a lower risk versus only investing in individual stocks. Keep in mind, when people are speaking about “the Dow,” they’re referring to the Dow Jones Industrial Average (DJIA). This index currently tracks 30 large, publicly owned companies (think The Walt Disney Company and Apple) — that trade on the New York Stock Exchange and Nasdaq. It can be used as a gauge of the market’s performance from day-to-day.

As I always say, you can’t predict the market. It will unpredictably fluctuate but has historically recovered over time. So you shouldn’t panic when the market declines, and you shouldn’t try to time your buys. The way to invest for long-term gains is to invest consistently over an extended period.

And yes, in general, this means you should avoid cashing out your retirement account early and facing penalties and potential losses. As Matthews noted, if you invest just $83 each month, you will have put in nearly $1,000 at the end of a year. Due to compounding, your investment can grow exponentially in the long haul.

Related: Money Management: Leveling up in Uncertainty

Don’t forget to complete your research before you buy to help you consider how much of your portfolio you want to have in stocks. By the way, stocks are riskier than bonds. Matthews said, one widely referenced rule is that the percentage of money you invest in stocks should equal 110 minus your age. Periodically, you can review your accounts and “rebalance” to bring a portfolio in line with original allocation goals. Some target-date retirement funds will automatically rebalance for you, but you should still review them.

Also remember investment funds can have management fees, which can range from .10 percent to more than two percent of the assets under management. Ideally, you want all of the fees to be on the lower end. For instance, the investment management company Vanguard (which I like) is known for its lower fees on its more than 400 funds. In addition to real estate and business ventures, market investments offer a way to build wealth as well. And I agree: The market is worth your time.

Remember, you can start investing with as little as a few dollars — and through your phone with apps from E*TRADE, Robinhood, and Charles Schwab. As a cautionary tale, the market has historically righted itself over time, but it’s not a place for emotions. So make a long-term plan, consider regularly investing, and try to be proactive and not reactive. What I mean by this is not to become emotionally invested when the market goes through its waves of ups and downs.

Remember, you can start investing with as little as a few dollars — and through your phone with apps from E*TRADE, Robinhood, and Charles Schwab. As a cautionary tale, the market has historically righted itself over time, but it’s not a place for emotions. So make a long-term plan, consider regularly investing, and try to be proactive and not reactive. What I mean by this is not to become emotionally invested when the market goes through its waves of ups and downs.

You can’t time the market. It will unpredictably fluctuate but has historically recovered over time.

If you have questions about your specific situation, including those about saving for children’s college education, you should consider speaking with a certified financial professional. In the meantime, continue learning about key terms and best practices, resolve to remain calm, and dip in a bit — even with small amounts.

Created by nationally recognized millennial money expert Tonya Rapley, My Fab Finance is a leading financial education and lifestyle blog for millennials who want to become financially free and do more of what they love.

Disclaimer: blacklove.com does not offer any financial advice, and the views and opinions expressed in this article are the author’s viewpoints and opinions.

Related Articles

Bozoma Saint John talks Black motherhood, grief, self-love, and finding joy again. Don’t miss her powerful conversation on building legacy and living boldly.

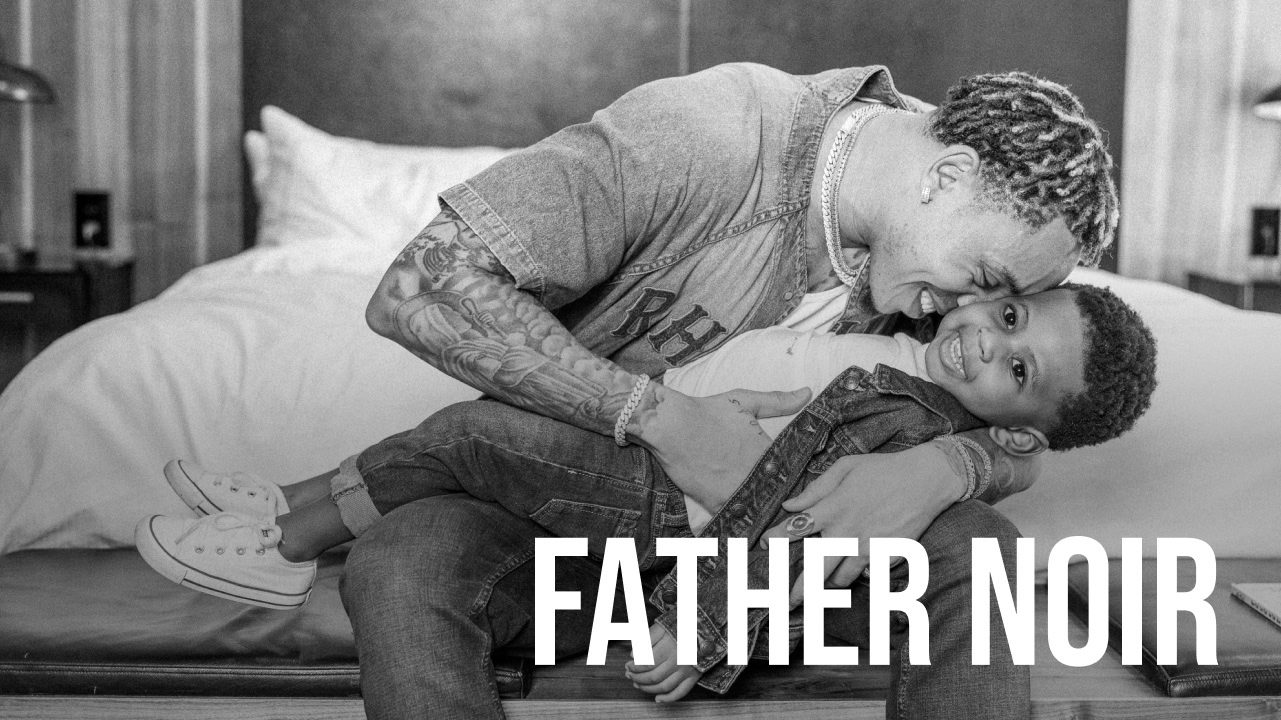

Tyler Lepley shows the beauty of Black fatherhood, blended family life with Miracle Watts, & raising his three children in this Father Noir spotlight.

Black fathers Terrell and Jarius Joseph redefines modern fatherhood through love, resilience, unapologetic visibility in this Father Noir highlight.

Featured Articles

When Elitia and Cullen Mattox found each other, they decided that they wanted their new relationship together, their union, to be healthier and different.

Celebrate their marriage and partnership with the release of the documentary “Time II: Unfinished Business”

The vision for our engagement shoot was to celebrate ourselves as a Young Power Couple with an upcoming wedding, celebrating our five year anniversary - glammed up and taking over New York.

Meagan Good and DeVon Franklin’s new relationships are a testament to healing, growth, and the belief that love can find you again when you least expect it.

Our intent is to share love so that people can see, like love really conquers everything. Topics like marriage and finance, Black relationships and parenting.

HEY CHI-TOWN, who’s hungry?! In honor of #BlackBusinessMonth, we teamed up with @eatokratheapp, a Black-owned app designed to connect you with some of the best #BlackOwnedRestaurants in YOUR city – and this week, we’re highlighting some of Chicago’s best!