Courtesy of rawpixel.com

Courtesy of rawpixel.com

Courtesy of rawpixel.com

While 2020 has been a rollercoaster ride for us all, the economic impact caused by COVID-19 has played a significant factor in disproportionately affecting Black Americans. Not to mention following the tragic deaths of many unarmed Black men and women including, George Floyd, Breonna Taylor, and Ahmaud Arbery, it ignited (once again) a community awakening to combat financial disparities and find ways to bridge the racial wealth gap through advocacy and support for Black-owned banks and businesses.

As a collective, to further accumulate Black wealth, it’s critical to understand the foundation of financial literacy and dismantle the misconceptions of the role debt plays along our financial journeys. “Financial literacy is an understanding of how money works and what money can and can’t do. It’s also an understanding of how to deploy capital to achieve returns and the risk-reward that everything is negotiable,” said Kevin Cohee, Chairman and CEO of OneUnited Bank, the largest Black-owned bank in the country.

It was important for to speak with the Harvard Law School graduate as one of the leaders at the forefront for building Black equity and empowering our financial futures through the #BankBlack and #BuyBlack initiatives, a call-to-action in 2016 by Atlanta rapper Killer Mike.

“We need to use our power – both our spending power, our vote, and our voice – to demand criminal justice reform and to address income inequality,” Cohee said. During our conversation, it was apparent the business executive was a treasure trove of information! We spoke about the valuable essentials to building your financial portfolio, common money mistakes, potential solutions for Black millennials to close the racial wealth gap, and received a history refresher on the intersection of race and capitalism.

blacklove.com: In general, what are the most prominent misconceptions about how money works?

Kevin Cohee (Courtesy of Kevin Cohee)

Kevin Cohee: The racial wealth gap is an example. It originated because of bullying, racist tactics by the government, and white people taking illegal, immoral actions against Black people. It created natural opportunities for them that our communities didn’t have. Not allowing us to live in neighborhoods where housing prices were appreciating was huge, and not giving us access to equal opportunity in the workplace or access to capital. All of those things were real, and they exist even today.

However, if you understand money and how money works, those are challenges you can overcome. In many ways, money is an independent journey. If capital seeks returns, it seeks safe returns, and it’s doing that apart from you being black, white, green, or purple. It’s a commodity that functions by trying to make itself larger for the least amount of risk.

Related Articles:

Master P and Son Romeo Miller on Building Generational Wealth

Home Buying 101: Purchasing Real Estate During an Economic Collapse

Money Expert Tonya Rapley on How to Survive and Thrive in an Economic Crisis

BL.com: What are potential solutions for Black millennials to close the racial wealth gap?

KC: We can talk about it in a couple of different ways, but I’m going to talk about it from the perspective of net worth. Let’s say an average Black family has a net worth of $17,500, and the average white family has a net worth of $177,000. In my mind, that’s not a big difference. One transaction, such as purchasing a home, can accumulate that kind of net worth.

There are many avenues available to support home purchases today. It’s a matter of taking the time to accumulate the necessary information to understand how to purchase a house and not perceive yourself as being constrained. We tend to spend a lot of time imagining obstacles that are not actually in our way.

I believe OneUnited Bank will have a significant impact by educating Black people on how to engage in core transactions, a home, or multi-family housing, which in many ways, is better than a home. It’s someplace you can live and make money. Certainly, over a generation of becoming skilled at executing that set of transactions will help overcome the wealth gap. Once you expand your understanding, you begin to understand investments, such as stocks and bonds, and business opportunities.

Racism caused the problem, and what was (and is) being done to Black Americans is tragic and lacks humanity. It lacks the spirit of what America stands for. We have to take steps forward and make ourselves more financially literate by effectively participating in the capitalist system. Through that effective participation, we will make ourselves wealthier as a people.

BL.com: We’re currently in a national crisis, and many people are going through financial hardship. How can people make it to the other side of this pandemic by staying afloat without getting into tons of debt?

KC: Debt is one of those topics we have problems with because we don’t understand debt. Racism in our country caused Black Americans to have a lot of anxiety and misconceptions about the role of debt. We often think about it as something we shouldn’t have at all. Unfortunately, it’s the wrong way of thinking.

It’s one of those essential values we have to get rid of because it sets us back and stops us from being effective participants in society. Debt is probably the most critical tool for building wealth. If one understands money, one understands that debt is just a tool to make money. It’s not your enemy. It allows you to do more things than you would be able to do otherwise by allowing you to leverage capital, increase your returns, and the amount of money available to engage in transactions. It is critical to your success in a modern capitalist society and virtually impossible to do anything of any significance financially without it.

BL.com: What would you suggest are the valuable essentials that are needed along your financial journey?

Courtesy of pexels.com

KC: Today, the most important thing to understand is how to sell products and services over the internet. Among the megatrends affecting society right now, the internet is probably the most significant factor affecting natural success. If we’ve learned anything from COVID-19, we all have to understand that technology has driven us to the point where you have to be able to sell and market your products and services online. If you don’t, you may not be able to sell your product or service at all.

The internet has changed the opportunity set that’s available for business. It reset the capitalist model. That’s not to say there can’t be a business that thrives not connected to it, but it’s where the big opportunity set is. Knowing how to monetize social media platforms creates many business advantages.

Your ability to identify sub-groups of people to sell products and services to and reach those groups of people cheaply, also detached from your production process, are all factors that make it an amazing time to be on your financial journey. If you have a foundation of financial literacy, it allows you to adjust to the different circumstances or opportunities available at any particular point in time.

Related Articles

Discover why Jasmine Guillory’s latest novel Flirting Lessons is a must-read—and how the author continues to redefine modern romance with layered Black heroines, real emotional depth, and Black literature that feel both magical and true.

Bozoma Saint John talks Black motherhood, grief, self-love, and finding joy again. Don’t miss her powerful conversation on building legacy and living boldly.

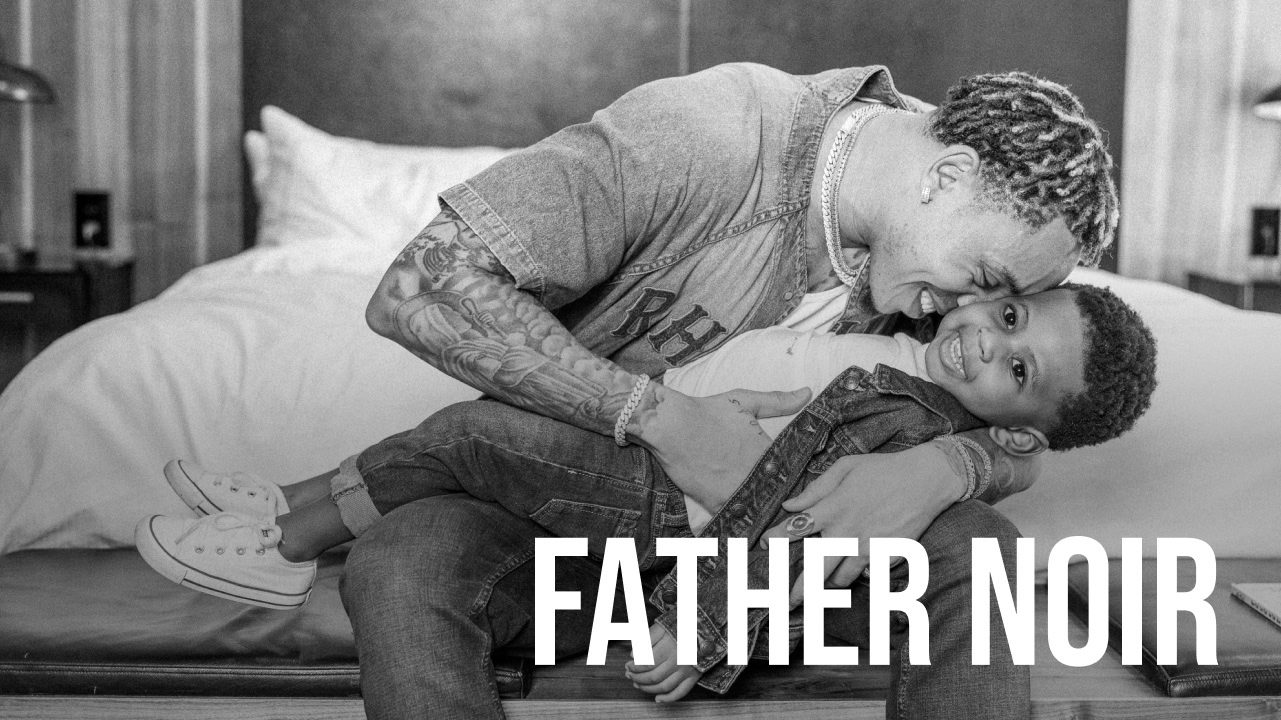

Tyler Lepley shows the beauty of Black fatherhood, blended family life with Miracle Watts, & raising his three children in this Father Noir spotlight.

Featured Articles

When Elitia and Cullen Mattox found each other, they decided that they wanted their new relationship together, their union, to be healthier and different.

Celebrate their marriage and partnership with the release of the documentary “Time II: Unfinished Business”

The vision for our engagement shoot was to celebrate ourselves as a Young Power Couple with an upcoming wedding, celebrating our five year anniversary - glammed up and taking over New York.

Our intent is to share love so that people can see, like love really conquers everything. Topics like marriage and finance, Black relationships and parenting.

Meagan Good and DeVon Franklin’s new relationships are a testament to healing, growth, and the belief that love can find you again when you least expect it.

HEY CHI-TOWN, who’s hungry?! In honor of #BlackBusinessMonth, we teamed up with @eatokratheapp, a Black-owned app designed to connect you with some of the best #BlackOwnedRestaurants in YOUR city – and this week, we’re highlighting some of Chicago’s best!