Family buying home

Courtesy of Shutterstock

Jullien Gordon, a real estate investor, author, and speaker (Photo courtesy of Jullien Gordon)

A house is not a home — and a home isn’t necessarily an asset. That last point is just one that came up in the fourth episode of the My Fab Finance’s webinar series.

In this edition, Tonya Rapley, the millennial entrepreneur who organized the five-day webinar, held a conversation with Jullien Gordon, a real estate investor, author, and speaker. A few of the topics they covered included buying real estate — specifically multi-family properties. And also, how buying these properties has helped Gordon gain financial freedom because as he states his passive income now surpasses all of his expenses.

Sounds like something to learn more about, right? As a writer who specializes in personal finance topics (among others), I’ve included the highlights from this talk specifically for blacklove.com.

First, here’s a more in-depth look at the speakers. Rapley is an entrepreneur and the creator behind My Fab Finance, who seeks to help millennials “break the cycle of living paycheck to paycheck so they can become financially free and do more of what they love.”

Related: Money Management: Leveling up in Uncertainty

Gordon is the creator of TheFreedomSchooI.com, an online program that “teaches business and life skills to professionals to help them increase their degrees of freedom in life and at work.” His mission is “to help 300 people achieve rent freedom through real estate investment coaching.”

On confidence and success

Gordon spoke about the need for an attitude of abundance even though we’re in difficult economic times. He stated some people might fear the current economic scene but said, “We have to stay in a wealth consciousness.”

Courtesy of Shutterstock

Multi-family investing

Gordon further emphasized we are currently in a buyer’s market, in part due to falling prices. He said his love for owning multi-family properties stemmed from his desire to have generational wealth. Unlike with flipping properties or wholesaling them, Gordon said multi-family properties can bring multiple benefits: cash flow, tax savings (including depreciation), the paying down of principal via tenants, and (potential) appreciation.

His suggestions in subsequent order for “would-be investors” are as follows:

—Try to invest where you live or close to it.

—Let’s say you can’t invest where you live because it’s too expensive. Then you should consider investing where you’re from because a smaller market may be better for your wallet.

—Another option, if you can’t invest where you’re from is to invest where you want to contribute to the community.

—If none of these options are feasible for you, then consider investing wherever your points of interest are.

But in any of these scenarios, you have to be ready! Good credit is ideal. If you don’t have good credit, he suggests paying for a credit repair service. You’ll also need proof of income because, with a limited inventory of multi-family homes available in the United States, there is competition for these unique properties.

Buying real estate during a recession

Gordon now begins the process by offering 80 percent of the February 2020 value of the home to enter into the deal with existing equity. He states, after buying, you need to set aside money in reserves every month to cover repairs over time and to cover periods of vacancy.

Related: Everything You Need to Know About Investing in a Downturn

With the fluctuating economy, I asked for his thoughts on how “would-be investors” can protect themselves against unexpected expenses? Such as if a tenant is unable to pay rent, which is possible, particularly these days. Depending on your level of risk, he says, you can enter into deals with three to six months of reserves upfront to cover everything from insurance, mortgage, and potential repairs. You’ll, of course, get the property appraised as part of the buying process and check other requirements before closing, but be sure to talk to your real estate agent for specifics.

Key takeaways

Credit: @gkiaphoto

Gordon mentioned that when you “buy a home,” you’re not necessarily a “homeowner.” As long as you’re paying a mortgage, you don’t own your home outright. He also dropped insider tips, that the best multi-family real estate deals are often found off-line.

It’s also essential to note that there are no guarantees on any investment, and it’s possible to lose money. For instance, with this kind of investment, you have to avoid contractor issues and other ancillary costs on your budget. But, if you qualify, it might be a way to round out your portfolio. However, if you have questions about your specific situation, please talk with a certified financial advisor.

Finally, if you need a confidence boost, you may also appreciate this talk. As a person who coaches others — and who’s found success as a writer, consultant, and more — I’m a believer in setting intentions, stating what we want, and going after it. And Gordon shares similar sentiments as he spoke passionately about making choices, being free, his “God-given purpose,” and helping others.

Created by nationally recognized millennial money expert Tonya Rapley, My Fab Finance is a leading financial education and lifestyle blog for millennials who want to become financially free and do more of what they love.

Disclaimer: blacklove.com does not offer any financial advice, and the views and opinions expressed in this article are the author’s viewpoints and opinions.

Related Articles

Discover why Jasmine Guillory’s latest novel Flirting Lessons is a must-read—and how the author continues to redefine modern romance with layered Black heroines, real emotional depth, and Black literature that feel both magical and true.

Bozoma Saint John talks Black motherhood, grief, self-love, and finding joy again. Don’t miss her powerful conversation on building legacy and living boldly.

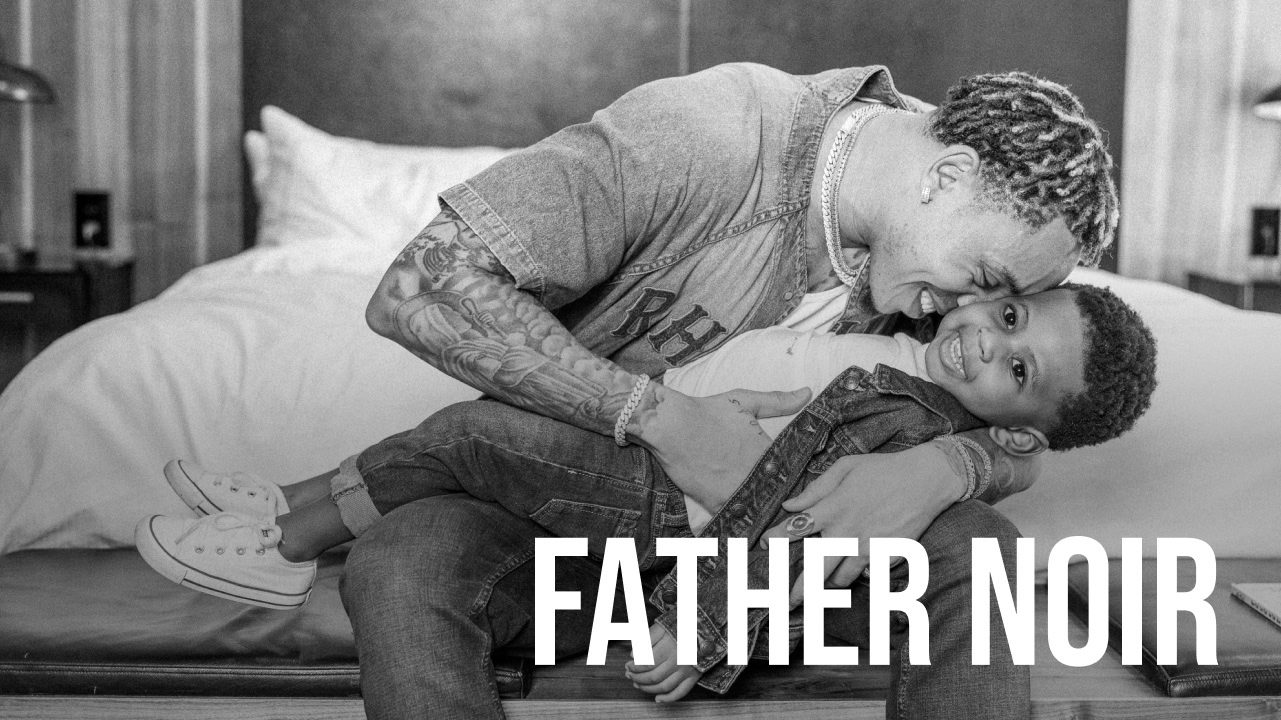

Tyler Lepley shows the beauty of Black fatherhood, blended family life with Miracle Watts, & raising his three children in this Father Noir spotlight.

Featured Articles

When Elitia and Cullen Mattox found each other, they decided that they wanted their new relationship together, their union, to be healthier and different.

Celebrate their marriage and partnership with the release of the documentary “Time II: Unfinished Business”

Our intent is to share love so that people can see, like love really conquers everything. Topics like marriage and finance, Black relationships and parenting.

The vision for our engagement shoot was to celebrate ourselves as a Young Power Couple with an upcoming wedding, celebrating our five year anniversary - glammed up and taking over New York.

Meagan Good and DeVon Franklin’s new relationships are a testament to healing, growth, and the belief that love can find you again when you least expect it.

HEY CHI-TOWN, who’s hungry?! In honor of #BlackBusinessMonth, we teamed up with @eatokratheapp, a Black-owned app designed to connect you with some of the best #BlackOwnedRestaurants in YOUR city – and this week, we’re highlighting some of Chicago’s best!