student-loans-black-couples-2025

Worried young Afro-American man wearing glasses typing sms on smart phone deep in thoughts without noticing his girlfriend spying, looking over his shoulder, trying to read what he is texting

Black Love in a Time of Student Loan Uncertainty

As the Department of Education faces over a million pending Income Driven Repayment (IDR) plans, many Black couples find themselves navigating the uncertain waters of student loan forgiveness. The temporary pause on loan forgiveness adds another layer of complexity to their financial planning, especially as the American Rescue Plan’s tax-free provision ends in 2025. For many, this isn’t just about dollars and cents—it’s about the future they envision together.

Understanding the Financial Impact on Black Couples

The potential return of taxable loan forgiveness in 2026 could mean substantial tax bills for borrowers. For Black families, who statistically possess less generational wealth, this could hit harder. In these moments, communication becomes critical. Couples must openly discuss their financial realities, share their concerns, and develop a plan that considers both immediate needs and future goals.

Navigating Financial Stress Together

These financial challenges aren’t just numbers on a page; they play out in daily lives. The waiting game for loan forgiveness approval creates stress that can spill over into relationships. Couples should view this as an opportunity to strengthen their partnership. By setting financial goals together and being transparent about individual financial histories, couples can transform a potential stressor into a source of unity.

Practical Steps for Financial Harmony

Start by creating a budget that accounts for potential tax liabilities. Discuss what happens if loan forgiveness remains taxable and how you’ll handle any bills that arise. Use this time to explore financial literacy resources together, and consider consulting a financial advisor who understands the unique challenges facing Black couples. By addressing these issues head-on, you can turn a financial obstacle into a stepping stone for growth.

Black Love’s Takeaway

The truth is, financial pressures like student loans can strain relationships. But what this situation shows us is the power of communication and planning. By facing financial realities together, Black couples can transform potential stress into a shared journey of growth.

The Shared Conversation

This week, inspired by the ongoing student loan challenges, discuss how financial stress shows up in your own relationship. Share openly about: How would we handle a sudden financial burden like a tax bill? What can this situation teach us about planning for the future? Then try: Create a joint budget that includes savings for unexpected expenses. Apply what you learned to strengthen your financial partnership.

Via Black Enterprise. Read the original.

Related Articles

Explore Michelle Obama's raw honesty about adapting to life as empty nesters and its impact on Black love.

Explore how 'The Chi's' end brings insights into love and community growth. Discover lessons Black couples can embrace.

Explore Marlon West's story and learn how music shapes Black love, relationships, and growth.

Featured Articles

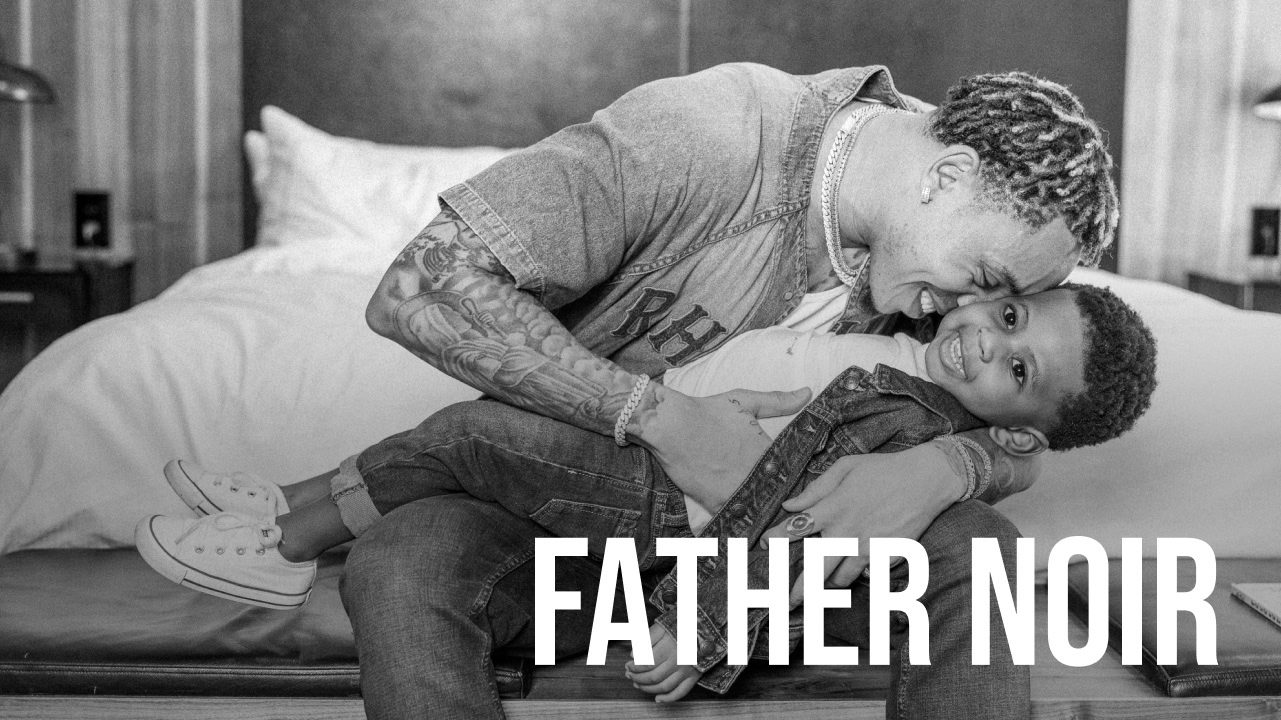

Tyler Lepley shows the beauty of Black fatherhood, blended family life with Miracle Watts, & raising his three children in this Father Noir spotlight.

Black Love caught up with Justin and Patrice Brim to delve deeper into their journey, unpack their inspirations, and discover what lies ahead for the incredible duo.

Celebrate their marriage and partnership with the release of the documentary “Time II: Unfinished Business”

Is the “mama’s boy” misunderstood? One writer breaks down how raising her sons has reshaped her thoughts on the complicated term.

I’ve always considered myself a humble person, but this experience was the ultimate test of my humility.

When Elitia and Cullen Mattox found each other, they decided that they wanted their new relationship together, their union, to be healthier and different.