Black Love Summit 2019

After attending the 2019 Black Love Summit, Christine Racheal shares the wealth-building advice she received during the “Couples and Coins” panel.

“Click here for a free seminar on financial freedom.” “Join the webinar and learn to invest in cryptocurrency.” We see them everywhere — social media ads and random emails soliciting our participation in schemes (I mean) endeavors that would improve our financial well-being. As creative, entrepreneurial-minded individuals, we seek opportunities to learn, grow, develop, and protect what we’ve cultivated. There are endless opportunities to educate ourselves on becoming prosperous, productive individuals, but there are few (if any) that cater to the wealth-building couple in the way the Black Love Summit has.

Created specifically for couples seeking to build an empire and leave a legacy for their little ones, the “Couples and Coins” panel at the 2019 Black Love Summit delivered expert advice to protect your assets after you’ve secured the bag. The panel focused on the maintenance of the marital relationship as couples lay a sturdy foundation for a healthy financial future. Having attended the event solo (the hubby was away on business), I was front and center, prepared to soak it all in and excited to share my notes upon his return. The expectation was that panelists would discuss going after “the dream” or “the vision” and making wads of cash in the process, but what they offered was more valuable than money.

Created specifically for couples seeking to build an empire and leave a legacy for their little ones, the “Couples and Coins” panel at the 2019 Black Love Summit delivered expert advice to protect your assets after you’ve secured the bag. The panel focused on the maintenance of the marital relationship as couples lay a sturdy foundation for a healthy financial future. Having attended the event solo (the hubby was away on business), I was front and center, prepared to soak it all in and excited to share my notes upon his return. The expectation was that panelists would discuss going after “the dream” or “the vision” and making wads of cash in the process, but what they offered was more valuable than money.

Trust is the foundation of building wealth with your partner.

The fun-loving and prosperity-minded duos, Kevin and Melissa Fredericks, and Karli and Ben Raymond, shared their histories with money — all of them growing up in poverty — and discussed their current investments, which they explained are designed to trickle down to their future generations. But that’s not it. These couples emphasized the importance of stability and trust in their marriages, which catapults them into improved fiscal responsibility and to think more progressively.

Related: Sex, Laughs and Lasting Love at the 2019 Black Love Summit

My husband and I are both entrepreneurs. We chose the pursuit of our creative passions over the cushy desk job with benefits and built-in vacation days. While fulfillment is never a question, our choice is void the 401K retirement package and paid vacation days. While any day can be a vacation, it comes at the expense of—let’s say, not making money. Secondly, as a writer (and my husband, a jazz artist), there isn’t currently a brick and mortar store, café or dry cleaners to leave behind for the babies. So, how do we carve out finances for the “now” without allowing work to invade the privilege of vacationing when we desire? And secondly, how does the creative community (writers, musicians, actors, etc.) build a nest-egg for their offspring in the absence of something tangible? They answered all of my questions and more during the panel. Here’s what I learned:

1. Trust is the foundation of building wealth with your partner.

Having a joint account with your partner is one way to hold each other accountable. Karli and Ben revealed that they share at least one joint account although they have others. “We made the decision that there would be no secrets in our finances,” Karli said. “It’s good to know what the other person is doing.” For example, Karli suggested that couples establish a threshold amount that elicits a discussion. For instance, if a purchase costs over $100, it must first be agreed upon.

If you want to know the financial structure in the Raymond home, I’ll let you in on it. “I pay the bills that affects your credit. She pays all the other bills,” Ben said. And I’m sure this structure was imperative after Karli’s visit to Ben’s dark apartment revealed that the electricity company had sent one red notice too many.

Kevin and Melissa Fredericks

As for Kevin and Melissa, they revealed that Melissa accesses the account for most of their financial responsibilities. Being in a relationship since college, they have mastered communication when it comes to finances, except for that time Kevin made a random car purchase. Melissa shared her frustration with his “miscommunication” and it brought home the notion that being able to trust your partner to make financially responsible decisions that impact the family unit is key. Like any other incident, trust must be rebuilt, and this couple proved that it is possible.

I listed this point first because we’re six years in, and my husband and I have yet to create a joint account. I can’t say there are any skeletons in my spender closet, but I know (by only what I see) that my husband can spend hundreds any given week on a new drum, or keyboard, or microphone, or computer, or any technology that he is not currently in possession of. I’m sure he can recall all the sales items in our local music shops better than the ads announcing them, so I just throw them all away when they come in the mail. Because the bills are paid, I never felt the need to look over his shoulder when it comes to his spending. Perhaps when there is a shift in objectives or goals, we may have to tighten up and limit spending, but until then, I enjoy the peace of not even knowing what’s streaming from his pockets and into music stores and eBay.

2. Model the behaviors you want to develop in your children.

This idea wasn’t emphasized during the panel discussion, but there was something about Melissa’s remembrance of her father, and the impact his actions continue to have on her in adulthood that was incredibly eye-opening. “I remember my dad balancing his checkbook,” she said. “It taught me to be responsible with money so that I would have something to leave my kids.” Unlike her husband, whose family vacationed often to escape the reality of poverty, Melissa learned to be frugal and save wherever she could.

Melissa’s father may have left a lasting impression on her ability to keep the bills in line, but the Raymond’s have begun to influence their children in their own way. Adopting the motto to “work hard and play hard”, they waste no time instilling it into their children—and having a stamp on your passport at 6-months-old definitely bears witness. “Our child started going out of the country when he was six months old. Our goal is to show our children a way of life,” they shared.

These points were noted and immediately applied. We shape our children’s experience and influence who they will later become. Parents have an incredible role in the lives of their little ones.

3. Find ways to make money beyond your career (or any additional labor).

Ding! Ding! Here was the answer to my “vacation days” question. I was reminded that it is possible to make money while you sleep. Investments are one way, and self-operating business models are another — like utilizing drop-shipping services.

I was reminded that it is possible to make money while you sleep.

There are numerous ways to make investments and benefit from the returns, and the panelists have mastered it. “I want to be able to pass on something to my kids — a house or land,” Kevin said. “I have investments outside of going out to tell jokes or doing a podcast.” The fluctuation of an entertainer’s earnings can be offset by solid investments that have a steady return. Not only can we factor in the downtime being balanced by a continuous flow of income that doesn’t require any physical labor, we can also use that time to insert a vacation.

“When it comes to wealth management as an entrepreneur you need two people on your team: an accountant and a lawyer,” Melissa suggested. So, while saturating your 2020 vision board with magazine cutouts, glitter, and dollar bills with added zeros, pencil in a stick figure of these two individuals to help safeguard your wealth and even save you money in the long-run. (Sorry, that was a note to self.)

4. Don’t despise small beginnings, but start somewhere — soon.

Each of our panelists described growing up with great lack and hardships. Many people can relate, including myself, but the mere presence of business savvy, successful couples was enough to be inspired.

“We’re not having the tough conversations about what we’re going to leave for our children.” — Karli Raymond

Karli and Ben Raymond

“We grew up knowing what it was like to have the lights cut off. I knew what I wanted but didn’t know how to get it,” Karli said. As much as we may understand how hardships can drive an individual to strive for greater, we would not intentionally allow our children to experience the same adversity. We must think selflessly about how we set up our children’s futures. “We’re not having the tough conversations about what we’re going to leave for our children,” Karli continued.

Related: Men on Vulnerability and Dating at the 2019 Black Love Summit

Like the other panelists, Ben grew up in poverty but acquired his first insurance agency at the age of 27. “I didn’t like corporate dress, so I started my own business.” Similarly, Karli enjoys her independence and ability to vacation when she wants. “Making money and growing wealth was important to me,” she said. This couple’s commitment to crafting a lifestyle they desired did not hinge upon their impoverished upbringing, but on their ability to focus on what they wanted until their vision became reality.

5. Stay aligned with what you desire.

Know where to go and who to talk to. Ben offered amazing insight on how to surround yourself with individuals who will help you to align. “Go to people who actually know what they’re doing,” he said.

Of course, a married person wouldn’t ask a single individual for marital advice. Right? (Insert shifty eye emoji.) Well, at least it wouldn’t make much sense to do so. Choose your circle wisely. Intentionally place yourself around people who you would model yourself after in some regard. Know that no one is perfect, but identify the various capacities in which others operate that could be beneficial to you if you mastered it as well. Those are the people to ask for advice, or to simply enjoy their company.

“We’ve committed to being married forever, so we hang out with other couples,” Ben stated. “And we surround ourselves with people who are moving in the right direction financially.” In other words, you become what you surround yourself with, so be intentional.

Who’s ready? If not you, I’m ready to dive into utilizing each suggestion offered by the panel. There is nothing like having a built-in partner with whom you can grow with physically, emotionally, spiritually and financially. This finance piece will take our relationship to new heights as we partner to establish wealth for future generations. It gives me so much peace to know that my children will not have the burden of starting from scratch. For them, the finish line will be closer because of the decisions my husband and I are making today.

For more on Christine Racheal, follow her @crachealwrites and check out more of her work here.

Related Articles

Discover why Jasmine Guillory’s latest novel Flirting Lessons is a must-read—and how the author continues to redefine modern romance with layered Black heroines, real emotional depth, and Black literature that feel both magical and true.

Bozoma Saint John talks Black motherhood, grief, self-love, and finding joy again. Don’t miss her powerful conversation on building legacy and living boldly.

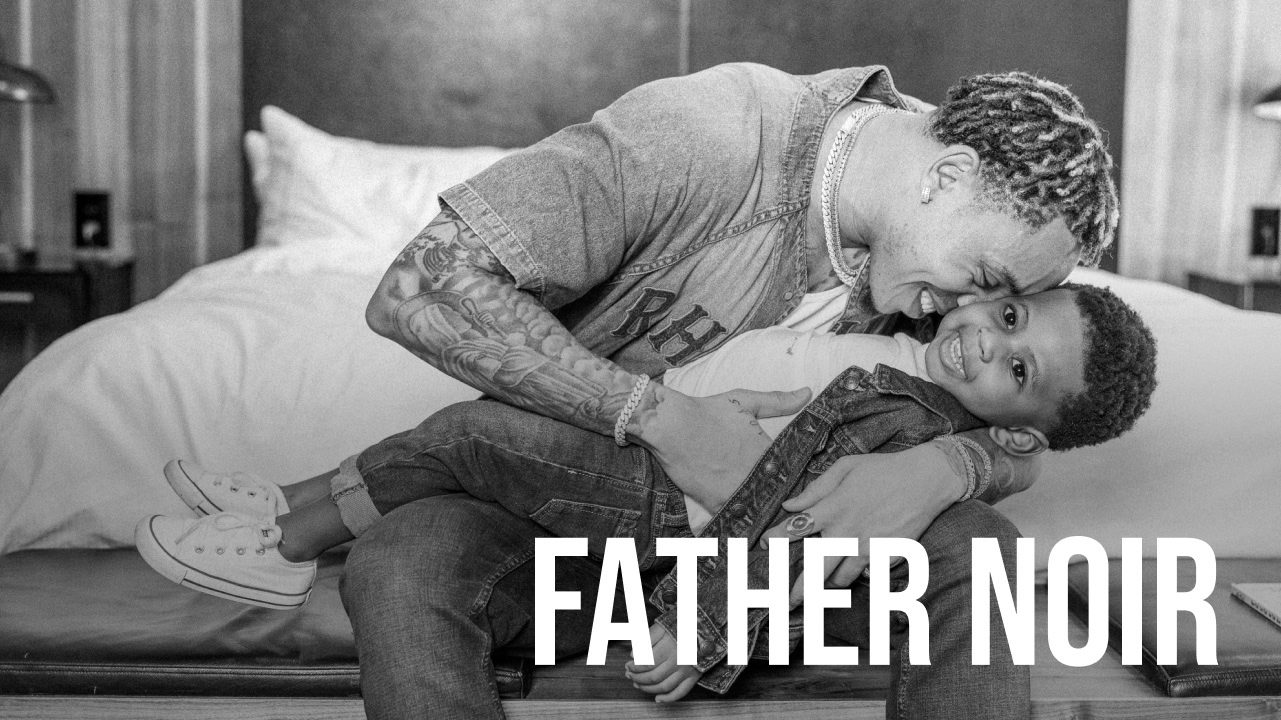

Tyler Lepley shows the beauty of Black fatherhood, blended family life with Miracle Watts, & raising his three children in this Father Noir spotlight.

Featured Articles

When Elitia and Cullen Mattox found each other, they decided that they wanted their new relationship together, their union, to be healthier and different.

Celebrate their marriage and partnership with the release of the documentary “Time II: Unfinished Business”

Our intent is to share love so that people can see, like love really conquers everything. Topics like marriage and finance, Black relationships and parenting.

The vision for our engagement shoot was to celebrate ourselves as a Young Power Couple with an upcoming wedding, celebrating our five year anniversary - glammed up and taking over New York.

Meagan Good and DeVon Franklin’s new relationships are a testament to healing, growth, and the belief that love can find you again when you least expect it.

HEY CHI-TOWN, who’s hungry?! In honor of #BlackBusinessMonth, we teamed up with @eatokratheapp, a Black-owned app designed to connect you with some of the best #BlackOwnedRestaurants in YOUR city – and this week, we’re highlighting some of Chicago’s best!