Finance Expert Tonya Rapley (Courtesy of @tonya.rapley/Instagram)

Finance Expert Tonya Rapley (Courtesy of @tonya.rapley/Instagram)

Made in Partnership with

Finance Expert Tonya Rapley (Courtesy of @tonya.rapley/Instagram)

Hey Black Love Fam! Managing Editor Yasmine Jameelah here. Black Love’s financial literacy show “All Things Money“ is back for season 2. Our host and finance expert Tonya Rapley is here to break down what can be difficult to discuss – our relationship with money. With season 2 well underway, I’ve got you covered with five financial wellness tips from this season that I can’t get enough of. If you haven’t seen any episodes, not to worry! To watch past and upcoming episodes of season 2 of All Things Money presented by Chase, head to our YouTube channel and stay tuned for new episodes of All Things Money every #WealthWednesday on Instagram!

5 Financial Wellness Tips From Financial Expert Tonya Rapley

-

- Before you say I do, make sure your financial vision for your relationship is aligned.

Courtesy of rawpixel.com

Is it just me, or are the Gwen Guthrie lyrics “no romance without finance” playing in my ear right about now?! Alignment is key, especially as it relates to finances. It’s essential to discuss your financial status with your partner as soon as your feel the relationship is getting serious. Why? According to this Ramsey Solutions survey, money fights are the second leading cause of divorce, behind infidelity. Be proactive in these conversations with your spouse; the future of your relationship could depend on it.

-

- Savings are essential, not optional.

Courtesy of rawpixel.com

A savings account is something that you should consider; it’s something that you need — period. I loved Tonya’s emphasis on it’s importance because these past few years have been BEYOND challenging for all of us, and financial challenges can make life even more difficult! If you’re considering opening a savings account, remember that you need a traditional savings account and emergency savings account for anything unforeseeable. Fun fact, I have several savings accounts that I name with intention. My favorite account is called Next Chapter, and I named it to manifest my new apartment last year (and I moved in last week.)

Related Articles:

Money Moves: Black Financial Influencers You Should be Following

How to Discuss Finances With Your Partner and When

What I Learned From All Things Money, “Financial Freedom” (VIDEO)

-

- We teach our kids about money through our actions.

Courtesy of rawpixel.com

My parents taught me a lot about financial literacy, whether they know it or not. My father always had expensive cars and clothes, but he often found himself in a jam needing to borrow money from someone, and my family made it clear to me (through their commentary) that he wasn’t responsible. It was hard to hear and truthfully embarrassing. My mother was the total opposite. She never believed in paying full price for anything, and she always talked to me about the importance of savings. Still, as a single mother, there were many times that she struggled financially, and we always had clothes on layaway, and she worked multiple jobs constantly. As an adult, I’ve made sure that even though like my father, I like nice things, my savings account looks nicer than I ever could, and that credit score stays as high as it can. My point in all this? Your children are watching you as you make financial choices for your family, make sure that you’re setting a good example.

-

- When investing, start small. You don’t want to invest money you can’t afford to lose.

Courtesy of pexels.com

Ima keep it real with y’all, I still have no clue how to operate NFT’s, nor do I understand most investment advice, and this is why Tonya’s help has been necessary. When we approach investment, we often think of it as this concept that we don’t understand, but after watching All Things Money, here’s what I learned — we’re investing all the time. If you have a 401(k), you’re investing. If you’re an entrepreneur, you’re investing. If you’ve purchased art, you’re investing. There are many ways that you can invest your money in the hopes of establishing wealth, but always remember it’s okay to start small!

-

- Before you go full-time as an entrepreneur, test your product as a side hustle.

View this post on Instagram

Shout out to all my fellow entrepreneurs! Yes, I’m Black Love’s Managing Editor, but I also own my own business. Founding Transparent & Black is the greatest thing I’ve ever done, but I am a firm believer in multiple streams of income (especially as a solo founder and a single woman.) In tandem with being a business owner, I also have a journalism degree from CUNY. After graduation, I intended to put my skills to use in a space that supported me as a journalist and a creative/entrepreneur and I found that at Black Love. If you have a business and, like me have dreams and goals, understand that I’ve been where you are. But allow yourself the financial support of a job (even part-time), spouse, or additional support to assist you as you go after your dreams! We all need support, especially as you figure out how to successfully build/scale your business.

Now I want to hear from you all. Have you watched “All Things Money” or learned any financial tips you wish you knew as you first started earning money? If so share, let’s talk in the comments!

Related Articles

Discover why Jasmine Guillory’s latest novel Flirting Lessons is a must-read—and how the author continues to redefine modern romance with layered Black heroines, real emotional depth, and Black literature that feel both magical and true.

Bozoma Saint John talks Black motherhood, grief, self-love, and finding joy again. Don’t miss her powerful conversation on building legacy and living boldly.

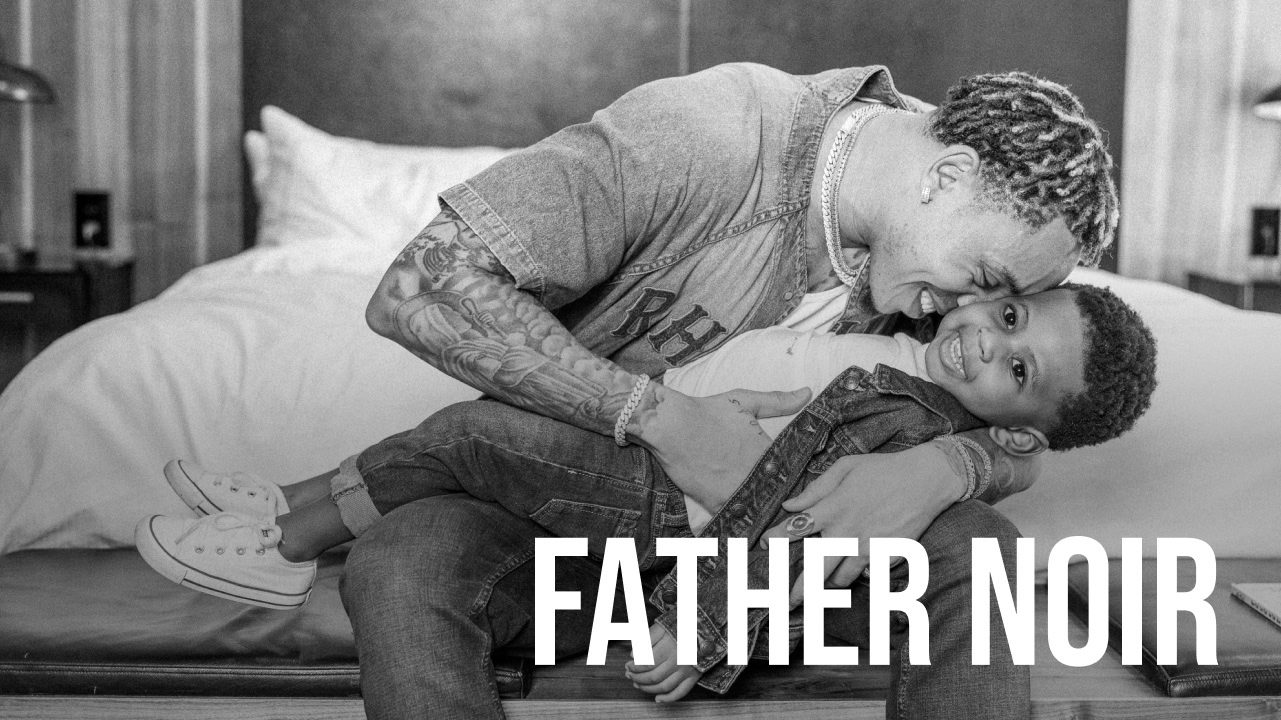

Tyler Lepley shows the beauty of Black fatherhood, blended family life with Miracle Watts, & raising his three children in this Father Noir spotlight.

Featured Articles

When Elitia and Cullen Mattox found each other, they decided that they wanted their new relationship together, their union, to be healthier and different.

Celebrate their marriage and partnership with the release of the documentary “Time II: Unfinished Business”

Our intent is to share love so that people can see, like love really conquers everything. Topics like marriage and finance, Black relationships and parenting.

The vision for our engagement shoot was to celebrate ourselves as a Young Power Couple with an upcoming wedding, celebrating our five year anniversary - glammed up and taking over New York.

HEY CHI-TOWN, who’s hungry?! In honor of #BlackBusinessMonth, we teamed up with @eatokratheapp, a Black-owned app designed to connect you with some of the best #BlackOwnedRestaurants in YOUR city – and this week, we’re highlighting some of Chicago’s best!

Meagan Good and DeVon Franklin’s new relationships are a testament to healing, growth, and the belief that love can find you again when you least expect it.